Payroll is a complex thing involving various tasks from collecting employee time to attendance data and calculating gross earnings to deductions. It also includes calculating net pay, issuing paychecks or direct deposits, and filing taxes. So, handling all these tasks manually is time-consuming and leads to a burden. Here where Payroll software for small business comes

Thanks to payroll software that enables a business or corporation to disperse salaries in a timely and orderly manner. Payroll software for small businesses can prove productive as it also handles tasks related to employees’ state insurance, provident funds, and social security funds.

Small businesses can utilize payroll software to eliminate the risks of dispersing delayed and inaccurate salaries. It also helps timely payment of other dues like PF and other funds to government agencies. Payroll software for small businesses can improve the overall productivity of a business by enhancing employee satisfaction. Several payroll software by credible companies are available in the market ensuring automated tasks with accuracy.

In this article, learn about the top 10 payroll software for small businesses with its functionalities and compatibility. However, before enlisting the best payroll software, let’s have a quick overview of the benefits of using payroll software.

Top Benefits of Using Payroll Software

For small businesses payroll software can prove a handy tool to streamline processes and reduce administrative burden. Some of the valuable benefits include:

- Automation: Payroll software lowers the chances of making errors in the computation of wages, deductions, and taxes and is time-saving.

- Accuracy: Reduced instances of payroll errors, compliance problems, and most importantly, penalties relating to inaccurate calculations.

- Tax Compliance: It helps organizations in non-affirmation of federal, state, as well as local tax laws, which would otherwise cost the company plenty.

- Labor Law Compliance: It also plays a crucial role in the proper implementation of labor laws in relation to wages minimum wage rates, remunerations, and overtime.

- Cost Savings: It can help to lower the costs of payroll processing since one can be able to avoid mistakes and also avoid having to hire more employees to deal with the issues.

- Accurate and Timely Payments: Payroll software’s main focus is to deliver paychecks to the employees on time, and in proper amounts, which enhances their satisfaction.

- Growth Accommodation: Payroll software can easily scale the working team without many changes to payroll management systems.

- Reduced Administrative Burden: Saves a lot of time for business owners and managers to do what they do best, that is managing the business.

10 Best Payroll Software for Small Business

From streamlining salaries-related tasks to payment of taxes, government dues, and other payments, Payroll software for small businesses is an efficient digital solution. Here are the most preferred online payroll software for small businesses and HR solutions

1. Gusto

Gusto is a leading payroll software that contains comprehensive payroll features and helps businesses of all sizes streamline the payroll process. The software is preferred for its user-friendly interface and is powered with features including automated payroll, time tracking, and HR tools.

Why Choose Gusto?

- The software is efficient in automating all payroll-related tasks including calculations, deductions, and tax filing.

- Gusto enhances proficiency and productivity by supporting accurate and timely payments.

- It also supports flexible pay schedules and empowers to choose weekly, biweekly, or monthly pay periods.

- Business owners can offer employees the facility of direct deposit or paperless paychecks.

- The software is effective in accurate time and attendance tracking.

Price:

- Simple: $40/month

- Plus: $80 $60/month

- Premium: $180 and $135/month

2. ADP Workforce Now

This is a secure, flexible, and integrated payroll software for small businesses. The highlighted features of this software include time and attendance tracking, benefits management, and compliance support.

What Makes APD Workforce Special?

- This software is capable of enhancing a business’s compliance with complex labor laws and regulations.

- APD Workforce is integrated with all core payroll features to automate the payroll process.

- From tax calculations and filings to direct deposit and paperless paychecks, this software handles varied tasks

- The payroll software can effectively track time and attendance as well as support overtime calculations.

Price:

- Starting from $62 per month

3. QuickBooks Payroll by Intuit

QuickBooks online payroll software empowers businesses to handle payroll processes with confidence. The software contains features like automatic payroll, same-day direct deposit, and mobile time tracking.

Special Features of QuickBooks Payroll

- This payroll software is capable of integrating seamlessly with accounting systems.

- QuickBooks Payroll can compute taxes, employee wages, and withholdings automatically, saving the company’s time and lowering the possibility of mistakes.

- With the direct deposit feature, it is easier for both employers and employees for workers to receive their paychecks straight into their bank accounts.

- Ensuring compliance with tax laws, QuickBooks Payroll can automatically compute and file federal, state, and local taxes.

Price:

- Starting from $5 per month

4. Paychex Flex Payroll Service

This is a tailored software for small businesses with features like direct deposit, time and attendance, and HR services. A simple-to-use payroll platform empowers businesses to handle all payroll processes in simple steps.

Top Features of Paychex Flex Payroll

- The software supports basic payroll tasks and ensures automated payroll processing, tax calculations, and filings

- Businesses can utilize features like direct deposit and paperless paychecks.

- The software is capable of doing time and attendance tracking and overtime calculations.

- Paychex Flex also offers customizable reports and data analysis contributing to enhancing productivity.

Price:

- Starting from $39 per month plus $5 per employee

5. Zenefits by TriNet

Zenefits software offers combine services of payroll with HR benefits administration, time tracking, and employee onboarding. This is a comprehensive digital solution for businesses of all sizes.

Why Use Zenefits

- This combined software solution offers payroll, benefits administration, risk management, and compliance services.

- The software empowers a business organization to streamline enrollment, administration, and communication of employee benefits.

- It also effectively manages health insurance, retirement plans, and other employee funds.

Price:

- Simple: $8/month

- Standard: $16/month

- Advance: $27/month

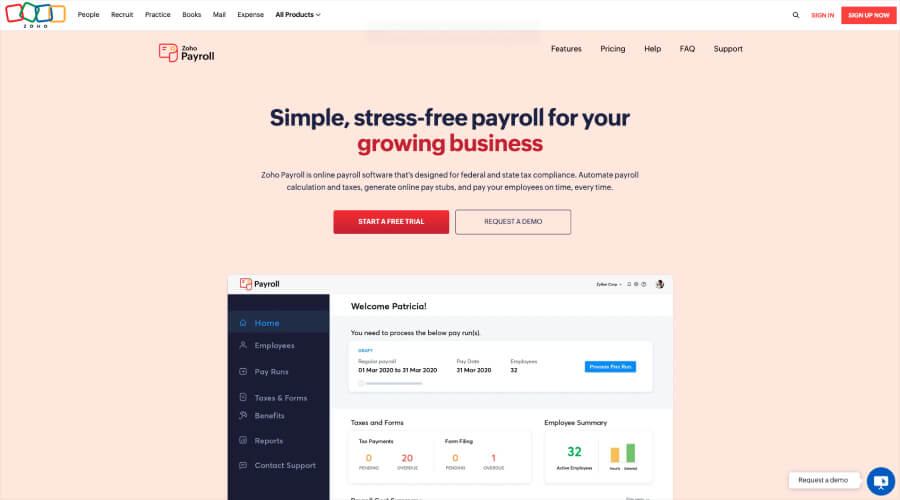

6. Zoho Payroll

Zoho Payroll is another best payroll software with a simple user interface helping in managing payroll tasks. This software is known for end-to-end payroll and HRMS solutions. It provides several tools to guarantee compliance, automate processes, and give insights into payroll information.

Highlight Features of Zoho Payroll

- By handling the computations, deductions, and tax filings automatically, Zoho Payroll lowers the possibility of mistakes and saves time.

- Online pay stubs, W-2 forms, and other payroll data are available to employees.

- This software can be integrated with Zoho applications including Zoho Books and Zoho CRM.

Price:

- Standard: $ 0.60 and ₹0.48 per employee/month

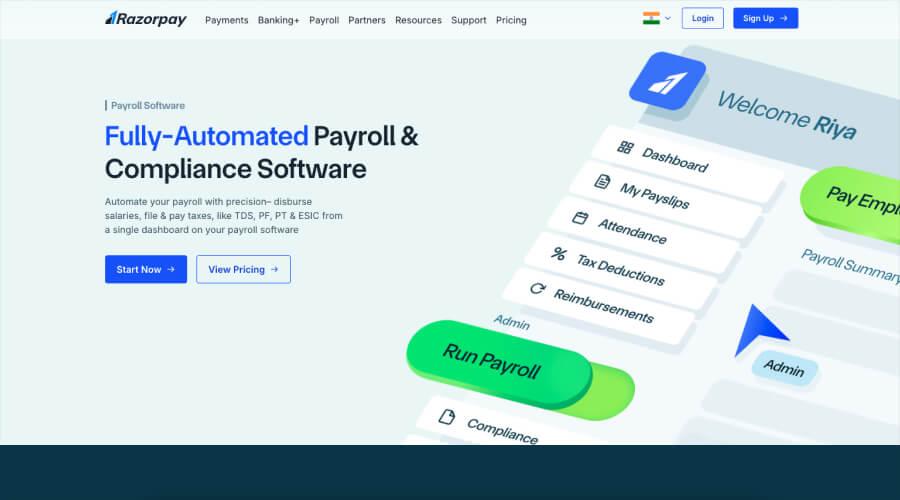

7. RazorpayX Payroll

This payroll software is a basic payroll solution that offers automation of payroll, taxes, and compliance calculation. With basic features like payroll, compliance, and attendance tracking, this software is ideal for startups and small businesses.

Features of Razorpayx Payroll

- The software is efficient in handling the basic attendance and leave tracking system.

- The payroll software is ideal for streamlining the dues like PF, ESIC, and PT.

- This software is also powered with a special letter generation system.

Price:

- Starting at $17.85

8. Quikchex: HR Payroll Software

Quikchex is a cloud-based payroll software to automates all the basic and core payroll services. With a simple interface, the software is ideal for paying employees and managing tax filings.

- Payroll cycles, allowances, deductions, and CTC structures can all be customized with the use of the program.

- Automating the processing of loans, advances, variable allowances, arrears, and Flexi-benefits is made easier using Quikchex.

- A business owner can create personalized payslips, FNF statements, and Salary Reports with the aid of this program.

Price:

- Starting at $95.26

9. HROne

HROne is an all-inclusive HR software platform with several capabilities to assist companies in efficiently managing their human resources. It is intended to assure labor law compliance, enhance employee engagement, and expedite HR procedures.

Highlight Features of HROne

- In order to guarantee correct and timely payments, the software automates tax deductions, direct deposit, and payroll computations.

- HROne is capable of reliably recording employee hours and computing overtime through integration with time-tracking systems.

- Employees can use the software to request and track leaves, and managers can view leave balances and accept or deny requests.

Price:

- Starting at $59.54/month

10. Wave Payroll

With a user-friendly interface, Wave Payroll is straightforward payroll software. The core features of this software include automating tasks, ensuring compliance, and providing insights into payroll data.

What Choose Wave Payroll?

- The software minimizes the possibility of errors and saves time by handling the computations, deductions, and tax filings automatically.

- This software assures businesses to comply with rules as the software is updated with the latest federal, state, and local tax legislation.

Price:

- Starting from $20 to $35 per month

Conclusion

In conclusion, payroll software for small businesses can increase efficiency, lower mistake rates, guarantee compliance, and improve overall performance. However, evaluating factors like features, cost, integration, customer support, and compliance can help in choosing the best payroll software.