![Best Accounting Software for Small Business [Free and Paid] - WeeTech Solution Pvt Ltd Best Accounting Software for Small Business [Free and Paid]](https://www.weetechsolution.com/wp-content/uploads/2024/08/Best-Accounting-Software-for-Small-Business-Free-and-Paid.jpg)

No matter whether you run a micro-business or a large business, managing financial transactions is vital for business growth. However, you cannot deny the fact that handling business accounting manually is complicated and time-consuming. Hence, it is crucial for businesses to look for reliable software to manage their accounts. You can easily record real-time firm transaction reports with the best accounting software, irrespective of the size of your business.

There is a plethora of free or paid accounting software that claim to offer unlimited access to transaction reports plus easy navigation. However, some of them can provide you with misleading information about your customers’ invoices and vendors’ payment reminders. And we don’t want you to fall into the trap of bad software. Hence, to help you choose the best accounting software, we have rounded up a list here. So, read this article.

We will walk you through the 10 best accounting software for small businesses with their features and pricing plans to help you make an informed decision. So, without any further ado, let’s get started…

Table of Contents

- What is an Accounting Software?

- Importance of Accounting Software in Small Business

- 10 Best Accounting Software for Small Business

First of all, let’s understand what accounting software is and why it is needed in the first place. Here we go…

What is an Accounting Software?

Accounting software is an advanced computer program that helps record and report business transaction reports. This incredibly optimizes your business from basic invoicing and payment reminders to project management and tax calculation updates. It also lets accountants and bookkeepers gain insightful reports into managing clients/customers and bank reconciliation reports. In addition, it saves you a lot of time that you would otherwise spend in understanding your monthly dealings. Top-notch accounting software can help you run your business seamlessly. It takes care of all your accounting needs, including billing, invoicing, payment, bookkeeping, and so on.

Why is so important?

Read ahead to know…

Importance of Accounting Software in Small Business

Before you pick the best accounting software for small businesses from the ones listed in the upcoming section, it is vital to understand the value of this tool for your business. Hence, take a look at the following discussion to learn its importance:

No.1: Create Invoices and Send Payment Reminders

Creating invoices and getting on-time payments are essential to ensure a seamless cash flow in your business organization. However, managing manual invoices is not only cumbersome, but also time-consuming. Moreover, this could be subject to errors and huge business losses. Yes, there is a high chance of errors with manual invoicing. Accounting software comes in handy in such a situation. Generating invoices becomes a breeze with these tools. They simply automate invoices and send payment reminders, ensuring error-free invoicing and on-time payments.

No.2: Global Payments

The major advantage of using this software is that you can collect payments from any part of the world. So, expansion is no longer a problem when you have software to handle your business accounts. These tools come with a multi-currency feature and let you accept currency from any nation. In addition, they also have a feature for exchanging the currency into your nation’s currency. It applies exchange rates and converts the international currency into your currency, making it easier to receive payments from international locations.

No.3: Bank Reconciliation

It comes integrated with a bank reconciliation feature that connects your bank account(s) easily. This feature allows you to fetch your bank statements of business transactions directly without any hassle. Using these statements, you can match your banking transactions with ongoing business activities. In addition, with bank reconciliation, prepare your audit report throughout the year.

No.4: Tax Compliance

Tax is yet another imperative part of a business. Even if you are running a small business, you need to file ITR. Of course, filing ITR is a task, especially if you have no knowledge. And the CAs charge way too high for filing ITR on your behalf.

But fret not! Accounting software makes it a cakewalk. With the best accounting software, you can file income tax returns effortlessly. Also, it updates you on the recent tax regulations and makes tax deductions calculations faster. Furthermore, it helps you to generate tax benefits reports so that you can stay organized and informed about tax filing season.

So, these are some of the things that make accounting software a necessity for your business. When the major chunk of your business is taken care of, you can easily focus on the core activities and plan for expansion within or outside the boundaries. Let’s now take a look at the best accounting software for small businesses. Here we go…

10 Best Accounting Software for Small Business

Here is our rundown of the top 10 business accounting software that small business owners can consider having to run their business seamlessly. Take a look…

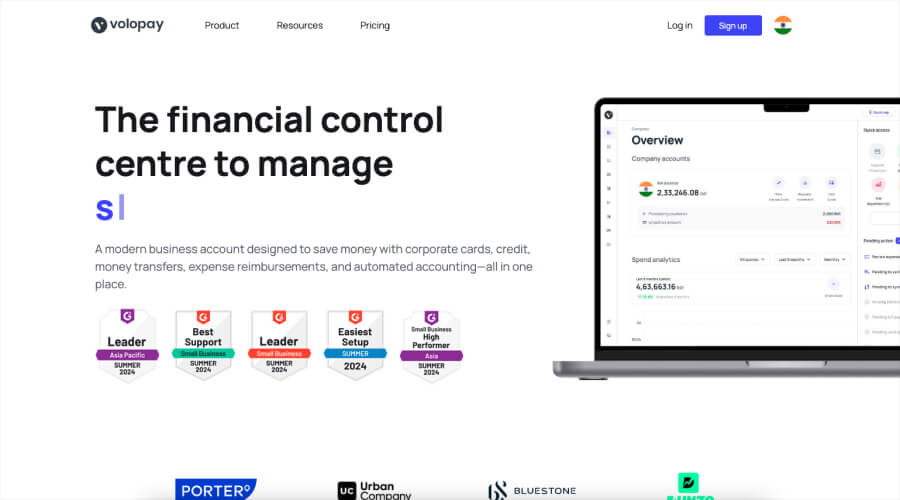

1. Volopay

Volopay is one of the most widely used software among accounting professionals and small business owners. This is a one-stop destination for various accounting needs, such as corporate cards, money transfers, bill payments, expense management, and automated accounting. Thanks to its Universal CSV feature, it can integrate with third-party accounting tools such as Tally, Netsuite, Quickbooks, MYOB, and more.

The reason behind picking Volopay is that you can easily access all accounting features through one dashboard here. This ensures transparency and visibility over daily business expenses. Furthermore, this is a scalable platform. It can easily adjust itself according to your organization’s needs. Plus, you should not worry about the safety and security features here. This works with a multi-level approval system, providing much-needed prevention from internet fraud, data stealing, or payment failure.

Key Features of Volopay

- Hassle-free business payouts (domestic and global)

- Physical and virtual cards to allow faster payments

- Customized spending limits on prepaid cards

- Record all financial transactions in real-time

- Multi-currency wallets

- Automation feature

- The mobile app is also available

Price

- Contact the service provider for detailed pricing.

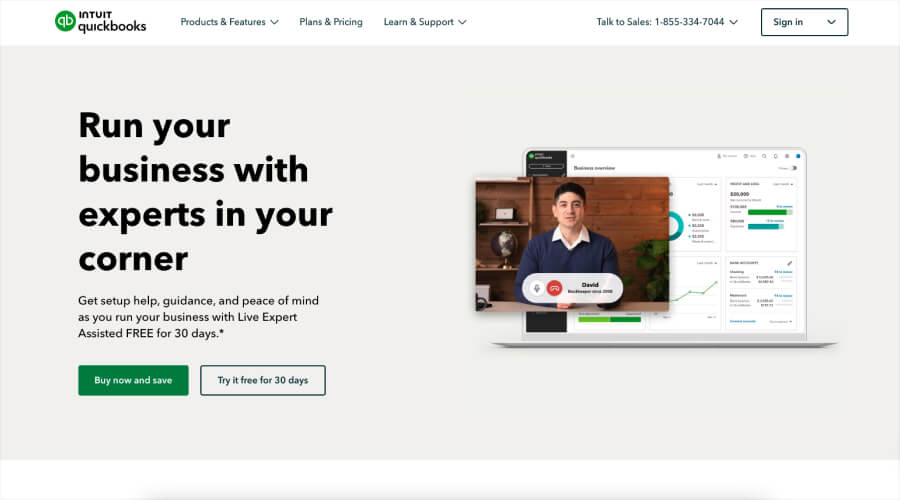

2. QuickBooks Online

The next best accounting software on the list is QuickBooks Online. Here, all accounting tools and features are conveniently accessible through one dashboard. This ensures bookkeeping automation and streamlines accounting book complexities. It eliminates all fears regarding tax deductions as it automatically applies tax rules. This, in turn, allows you to know about your business’ real earnings (excluding taxable income).

Most importantly, QuickBooks Online has a vast community. This implies that you get the support of numerous online resources and forums when you use this software. There, you can learn everything about this tool, including its usage and advanced accounting features. The best thing about this tool is that it is cloud software, which means you can access it through a website or mobile application. It offers numerous payment options, so make sure to choose the plan that best suits your needs. Track enhanced sales reports and streamline your business invoice reminders with QuickBooks Business Network.

Key Features of QuickBooks Online

- Access tax professionals’ help

- Automate bookkeeping and save time

- Real-time business tax deductions updates

- Enhanced sales reports

- Have receipts snap and categorize them

- View all your business balances on one dashboard

Price

It offers numerous payment options to help you choose the best one. Here are the plans:

- Simple: Starts with $17.50/month

- Essentials: $ 32.50/month

- Plus: $49.50/month

- Advanced: $117.50/month

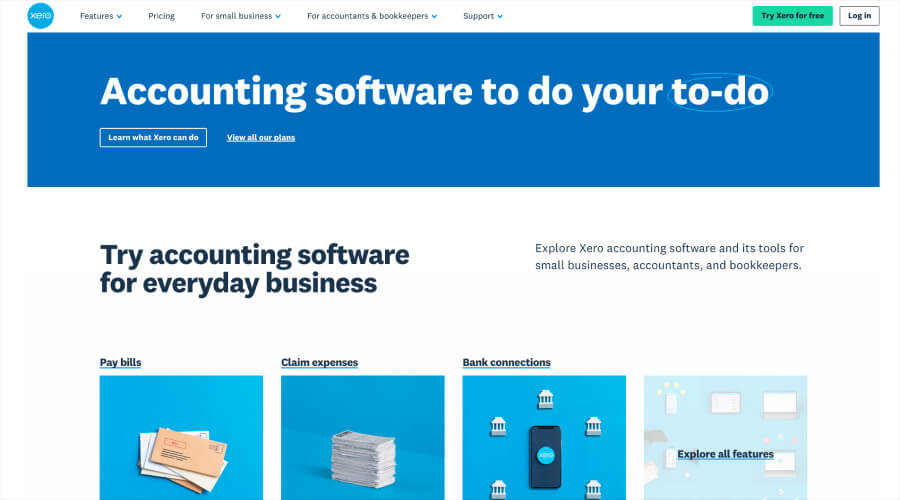

3. Xero

Another accounting software company that you can consider opting for is Xero. This is a perfect tool for small businesses, accountants, and bookkeepers. It comes with efficient and effortless accounting tools and features. It also has a dedicated app named Xero accounting app. This app helps you track your business balances, vendor payouts, and invoice reminders on the go. In addition, you can sync your bank with financials. Xero has taken business accounting to a new level altogether.

You can invite your advisors to do online accounting with you regardless of geographical boundaries. Plus, it comes with an option for personalization. You can customize your business needs and enhance its efficiency. Its major advantage is that it automates tasks like invoicing and reporting. Furthermore, it sorts out end-year tax return complexities, thereby enhancing your focus on business growth. You can choose this accounting software to make accounting or bookkeeping a breeze.

Key Features of Xero

- Online invoicing

- Allows you to automate bank transactions

- Comes with an expense management tool

- Third-party apps integration

- Handles bill payments

- Real-time accounting reports

- Create professional online quotes

- Manage inventory with real-time data

- Automate sales tax calculations

Price

Here are the plans

- Starter: $29/month

- Standard: $46/month

- Premium: $62/month

4. NetSuite

At number 4, we have NetSuite. If you are looking for accounting software that can revolutionize your business accounting, then NetSuite is your best option. It comes with AI capabilities, which makes business accounting a breeze. Through AI-embedded capabilities, it can streamline tax management, cash flow, general ledger, and more. This tool allows you to manage account payables or receivables, optimize AR, and do easy bookkeeping. Plus, its real-time AI insights help you leverage the benefits of data-driven decisions.

The best part is that it stores your business accounting data in the cloud. Consequently, you can access it from anywhere and at any time. Plus, your accounting team, employees, and executives can also collaborate with you through remote locations in real time. And yes, it can help your business with other services such as inventory management, customer management, e-commerce, and more.

Key Features of NetSuite

- Real-time reporting functionality

- Customized audit types

- Optimize cash flows

- Automate account payables and receivables

- Automate account reconciliation’

- Easy tax management

- Automate manual tasks such as journal entries, intercompany transactions, and more

- Fast payment processing

Price

- Contact the seller for detailed pricing.

5. FreshBooks

FreshBooks is another accounting software that has gained huge traction for its easy user interface (UI) and powerful features. It offers professional invoices and automates invoice reminders to ensure smooth cash flow in your business. It’s an easy-to-access and easy-to-understand tool. Its double accounting reports help you with business insights in no time. You can keep tabs on the money coming into your bank account and even take pictures of your receipts with this handy application. All of this helps users to file tax returns with ease.

In addition, FreshBooks enhances team collaboration in real-time. You can easily track your team’s progress with its efficient usage. Furthermore, it comes with online support so that you can understand how FreshBooks works in a simplified manner.

Key Features of FreshBooks

- Automate cash flow

- Track payment processes in real–time

- Customized invoice options are available

- Day-to-day business profit tracking is possible

- Capture receipt photos

- Cloud-based software

- Scalable

- Efficient project management

Price

FreshBooks’ plans:

- Lite: $7.60/month

- Plus: $13.20/month

- Premium: $24/month

6. Wave

Are you looking for a small accounting software that can make accounting and money management smooth and easy? If so, pick Wave! Wave is one of the best accounting software for small businesses. It offers incredible accounting tools and features. With its user-friendly dashboard, you can track your business health in real time from anywhere. It makes payment simpler and easier. Customers get the option of making instant payments using Apple Pay, Net Banking, and credit cards.

Here, you can get the support of an in-house accounting and bookkeeping team in case any problem crops up. Furthermore, it lets you keep track of your business income and expenses. You can always stay organized in the context of cash flows and payouts. Plus, it helps you in tax return with its advanced capabilities.

Key Features of Wave

- Create professional invoices

- Streamline online payments

- Make accounting easy and smooth

- Stress-free tax return

- In-house team support

- Cloud-based invoicing software

- The mobile app is available

Price

- The starter plans are available for FREE. Whereas the paid plan, i.e., the Pro Plan, is available for $16/month.

7. Refrens

Refrens is an all-in-one accounting software designed to simplify bookkeeping, invoicing, and financial management. It automates core accounting tasks, ensuring accuracy, compliance, and efficiency.

Trusted by 150,000+ businesses in 178 countries, Refrens is your complete accounting solution—efficient, automated, and hassle-free.

Key Features of Refrens

- Automated Accounting – Auto-records journal entries, updates ledgers and maintains a structured chart of accounts.

- Seamless Invoicing & Documents – Generate invoices, quotations, credit/debit notes, and payment receipts, all integrated into your accounting system.

- Audit Trail & Compliance – Tracks all edits to financial records for complete transparency and regulatory compliance.

- Financial Reports & Insights – Instantly access Balance Sheet, P&L Statement, Trial Balance, Tax Reports, and Payment Summaries.

- Expense & Payment Tracking – Monitor cash flow, record expenses, and manage outstanding payments effortlessly.

8. Sage Business Cloud Computing

Are you looking for accounting software that can go beyond number crunching? If yes, you should harness the capabilities of Sage Business Cloud Computing. This automates repetitive tasks and provides you with real-time insights. Sage Business Cloud Computing software saves you a lot of time that you can utilize to focus on business growth. It ensures you stay informed on tax regulation updates and the latest administrative changes.

Sage Business Cloud Computing customizes sales reports, mitigates calculation errors, and helps you to track business growth in real time. Furthermore, it allows team members to collaborate in real-time through its cloud software. So, if you are running a micro business or startup, this can offer you the best solutions with its basic accounting features. You can start with its basic plan to get accustomed to this accounting software and then opt for the premium ones.

Key Feature of Sage Business Cloud Computing

- Flexible software

- Automate payments, invoices, and reminders

- Error-free cash flow management

- Enhance team collaboration

- Easy to use interface

- Affordable plans

Price

Sage Business Cloud Computing offers two options, which are as follows:

- Sage Accounting Starter Plan: $9.55/month

- Sage Accounting Plan: $23.87/month

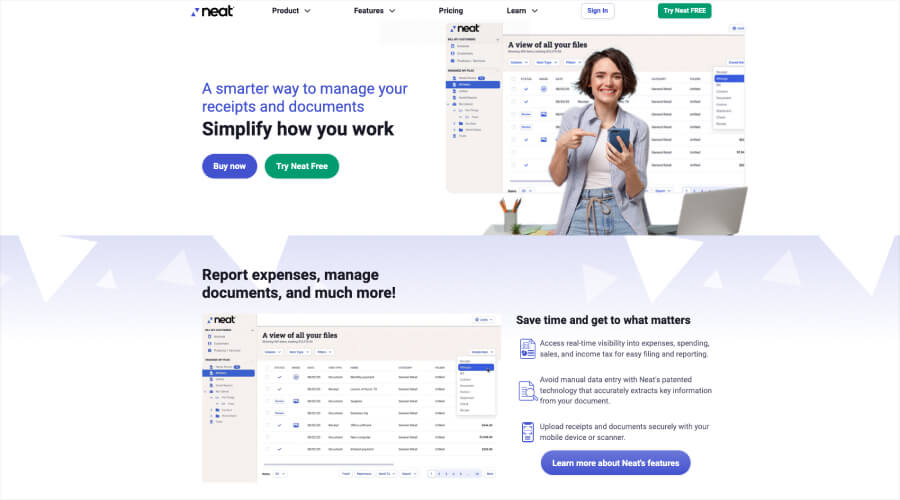

9. Neat

At number 9, we have Neat. Neat has become a one-stop destination for accounting professionals and small businesses. It makes managing accounting documents and receipts a breeze. It reduces redundant activities and helps you focus on the most important things. It offers real-time insights on sales reports, spending, expenses, and investment. This platform also allows for easy income tax filing and reporting.

This gathers all your documents and payment receipts in one place. And yes, you do need to bother about its efficient usage. It comes with a one-to-one training program and in-house team support. Its Neat technology has eliminated the need for manual data entry. Moreover, this technology is efficient in gaining insights into your document. You can choose to a suitable plan and stay organized with this platform.

Key Features of Neat

- Real-time insights into business expenses and spending

- File protection from malware threats

- Manage all your business transactions with Neat technology

- Reduce the need for manual data entry

- Reconcile bank statement receipts

- Prepare you for tax benefits

Price

Neat offers three different plans, which are as follows:

- Neat Base Subscription: $200/year

- VIP Service: $50 per year + Base subscription

- Automated Insights: $150 per year + Base subscription

10. Zoho Books

Last but not least is Zoho Books. Zoho Books is one of the best and most efficient accounting software for small businesses. It is a great blend of functionality and uniqueness. It simplifies business accounting and helps you to analyze its profit and loss in real-time. With its advanced tools, you can generate e-invoices and calculate tax deductions liabilities.

The best part is that you can access it through a website or app in no time. You can easily track your team’s log time and view business time anywhere and at any time. It offers numerous custom templates that allows you to customize Zoho Books fitting to your business needs. In addition, you can use its multi-currency feature to accelerate your business growth and enable smooth and seamless foreign transactions.

Key Features of Zoho Books

- Apply exchange rates globally to manage global transactions

- Transparent business expense reports

- Offers custom templates

- Custom reports

- Bank reconciliation

- Tax updates

- Affordable accounting software

- Real-time latest legislation updates

- Simple and easy online payments

Price

Here are the different plans that Zoho Books offer:

- Standard: $8.94/month

- Professional: $17.89/month

- Premium: $35.79/month

The Bottom Line

So, there you have it: 10 best accounting software for small business. As a small business owner, you should always be aware of efficient systems and platforms. Gone are the days when businesses needed to hire bookkeepers and accountants to record the firm’s transactions. New age problem necessitates new age solutions.

These tools make business accounting a breeze. An efficient accounting software comes with customized features to simplify complex accounting calculations. Furthermore, it stores the old data, which you can retrieve at any time for internal and external audits. You can choose to pick any software from the ones listed above. However, it is advisable to first consider your business needs and check the features of each tool prior to choosing the best one.

Happy Business Accounting… 😊 😊

Thanks for reading!

Hopefully, this article has been enlightening for you. Stay tuned for more such insightful articles!

![10 Best Accounting Software for Interior Designers [2025] 10 Best Accounting Software for Interior Designers [2025]](https://www.weetechsolution.com/wp-content/uploads/2024/11/Best-Accounting-Software-for-Interior-Designers-300x150.jpg)