In today’s fast-paced business environment, mergers, acquisitions, and investments are more prevalent than ever. However, before any major transaction occurs, companies must perform Commercial Due Diligence (CDD) to evaluate the target company’s market position, competitive landscape, and growth potential. Technology has transformed this traditionally complex and time-consuming process, providing better insights, efficiency, and accuracy. Let’s explore the intersection of commercial due diligence and technology, diving into how innovations are reshaping this critical business activity.

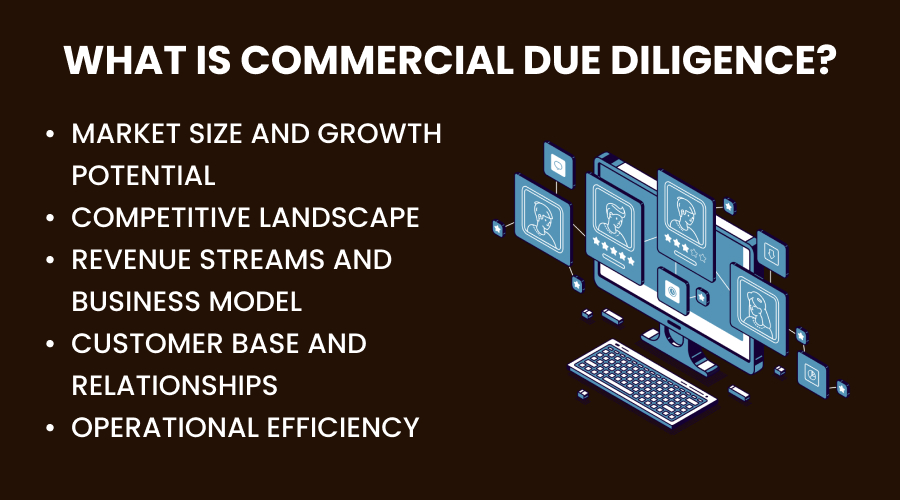

What is Commercial Due Diligence?

Commercial due diligence is the comprehensive analysis conducted by potential investors, buyers, or partners to assess a target company’s commercial attractiveness. It involves evaluating various aspects such as:

- Market Size and Growth Potential: Understanding the market environment and the company’s positioning within it.

- Competitive Landscape: Analyzing competitors and the target company’s market share.

- Revenue Streams and Business Model: Evaluating whether the company’s revenue is sustainable and scalable.

- Customer Base and Relationships: Analyzing customer satisfaction, loyalty, and concentration.

- Operational Efficiency: Reviewing the supply chain, production processes, and cost structures.

Traditionally, this process involved exhaustive manual research, interviews, and data analysis — time-consuming, resource-heavy, and prone to human error. This is where technology steps in.

The Technological Revolution in Commercial Due Diligence

The rise of big data, artificial intelligence (AI), machine learning (ML), and automation has revolutionized commercial due diligence. These technologies streamline processes, provide real-time insights, and enhance decision-making.

1. Big Data and Analytics

Commercial due diligence relies heavily on data. With the advent of big data, companies can now collect and analyze vast amounts of structured and unstructured data from various sources:

- Market Reports and Industry Data: Automated tools can aggregate data from market research firms, government reports, and financial databases.

- Social Media and Customer Reviews: Sentiment analysis tools extract customer feedback, providing insights into brand perception.

- Website Traffic and Online Behavior: Analyzing web traffic, SEO performance, and user behavior can reveal the target company’s digital footprint.

Real-time data analytics tools enable faster, data-driven decisions, reducing the reliance on manual number-crunching.

2. Artificial Intelligence and Machine Learning

AI and ML are game-changers in commercial due diligence. They enhance data interpretation, identify patterns, and predict future performance. Key AI applications include:

- Competitive Intelligence: AI tools track competitors’ activities, pricing strategies, and product launches.

- Customer Analysis: ML models predict customer churn rates, lifetime value, and behavior patterns.

- Financial Forecasting: AI-based models predict revenue growth, cost structures, and market trends with greater accuracy.

These technologies minimize human bias and offer predictive insights that go beyond traditional analysis.

Read More: AI Management Strategies to Use in Business

3. Automation and Robotic Process Automation (RPA)

Automation speeds up repetitive, time-consuming tasks in commercial due diligence. RPA can extract data from financial statements, customer databases, and other sources, significantly reducing manual input. For instance:

- Document Processing: Automated tools scan legal documents, contracts, and agreements for key terms and conditions.

- Data Entry and Reconciliation: RPA eliminates errors in financial data entry, ensuring accurate analysis.

- Report Generation: Automated reporting tools compile data into customizable, visually appealing reports.

The result is faster, more efficient due diligence with fewer human errors.

4. Enhanced Cybersecurity Due Diligence

With cybersecurity threats on the rise, technology-driven cybersecurity due diligence is crucial. Advanced tools now assess a target company’s digital infrastructure, identifying vulnerabilities, data breaches, and compliance risks. This ensures that acquirers understand potential cybersecurity liabilities before proceeding.

Read More: Most Common Cyber Security Threats and How to Prevent Them

5. Blockchain for Data Integrity

Blockchain technology ensures data integrity and transparency during due diligence. It provides an immutable record of transactions and ownership, which is invaluable when verifying a target company’s assets, contracts, and intellectual property. Blockchain enhances trust between parties, reducing disputes and ensuring accuracy.

Case Studies: Technology-Powered Commercial Due Diligence

Let’s look at a couple of real-world examples where technology has reshaped due diligence processes:

- Case Study 1: Private Equity Firm Leveraging AI A global private equity firm used AI-driven tools to analyze market data, customer sentiment, and competitor performance before acquiring a leading consumer goods company. The AI platform identified untapped growth opportunities in emerging markets, influencing the acquisition decision.

- Case Study 2: SaaS Company Acquisition with Cybersecurity Due Diligence A tech company considering the acquisition of a SaaS provider employed advanced cybersecurity analysis tools. The due diligence revealed critical vulnerabilities in the target’s software infrastructure. This led to renegotiations, ensuring the buyer secured additional protections and warranties.

Future Trends: Where Technology is Headed

The future of commercial due diligence is undeniably tech-driven. Some emerging trends include:

- Natural Language Processing (NLP): Automating the analysis of legal documents, contracts, and customer reviews.

- Virtual Data Rooms (VDRs): Enhanced, AI-powered data rooms that facilitate secure, real-time collaboration between parties.

- Predictive Analytics: AI systems will predict not only financial performance but also potential market shifts and regulatory changes.

- Augmented Reality (AR) and Virtual Reality (VR): In industries like real estate or manufacturing, AR/VR could provide virtual site tours and operational walkthroughs.

Conclusion

Technology is no longer a supporting tool in commercial due diligence — it’s a driving force. From big data analytics and AI to automation and blockchain, technology enhances accuracy, speeds up processes, and uncovers insights that were previously inaccessible. Companies that embrace these innovations position themselves for smarter, more informed transactions, ultimately gaining a competitive edge in the market.

The future of commercial due diligence is fast, data-driven, and tech-powered. Businesses that adapt to this evolving landscape will stay ahead, ensuring better deals and more successful acquisitions. In a world where speed and accuracy define success, technology isn’t just an advantage — it’s a necessity.